Who is Middle Class in India?

It is a class that occupies a socioeconomic position between the working and upper classes.

How many people lie in the middle class bracket?

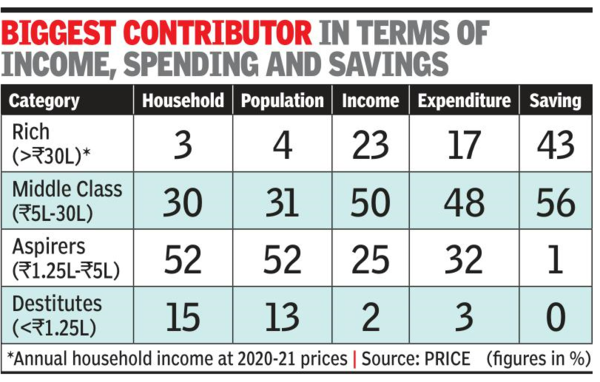

- 31% of India’s population is middle class in 2020-21 (estimated to grow to 63% by 2047) according to People Reserch on India’s consumer Economy (PRICE) and India’s Citizen Environment Report.

- The Middle class holds about 1/4th of country’s wealth.

The middle class is anticipated to grow from 432 million individuals in 2020–21 to 715 million (or 47% of the population) in 2030–31 and then 1.02 billion of India’s projected population of 1.66 billion in 2047.

The think tank defines a middle-class Indian as earning between US$ 1,322.77 (Rs. 1.09 lakh) and US$ 7,839.51 (Rs. 6.46 lakh) per year in 2020-21 pricing, or US$ 6,067.74 (Rs. 5 lakh) to US$ 36,406.41 (Rs. 30 lakh) yearly in household terms.

According to the report, the western region has the most super-rich households (803,000 versus 394,000 for the northern states), with Maharashtra (648,000 super-rich households) leading the way, followed by Delhi (181,000), Gujarat (141,000), Tamil Nadu (137,000), and Punjab (101,000). Maharashtra and Delhi are home to nearly half of India’s exceedingly rich. In terms of expenditure, middle-class households spend 8 times more than poor households, whereas rich households spend approximately 25 times more than poor households

Significance of 1991 for the Middle Class

- Size of the middle class approx. less than 1% of the population in 1990’s.

- Economic growth post 1991 reforms expands the size of the middle class substantially.

- The current middle class which is characteristic by consumer-driven sentiment can be said to have taken shape in this era.

Why Middle class is important?

• High consumption: Indian middle class contributes about 70 per cent to the total consumer spending. I accounts for expanding demand for consumer durables, housing, shopping malls, and other infrastructure.

• Tax contribution: Middle class accounts for 79 per cent of the total taxpayer base. A strong tax base enhances a country’s capacity to finance social services such as health and education, critical infrastructure etc.

• Savings and human capital: About half of the income, expenditure and saving is with this section. It is a major contributor to savings and human capital, as savings rates and the willingness to invest in human capital are higher amongst middle-class households.

• Virtuous cycle: Once the size of the middle class passes a threshold size, a virtuous cycle is initiated: a bigger middle

class spends more, leading to higher business profits, savings and investment, higher growth, and an even larger

middle class.

Challenges faced by middle class

• Increased cost of living: The cost of a “typical” middle-class lifestyle has increased faster than income. This has been driven by consumption patterns which tend to imitate the behaviour of richer peers.

o Worryingly, these trends have also led to an increasing debt burden on middle-class families, which is not

sustainable in the longer run.

o Also, the steep inflation eroded the purchasing power of this class and a large chunk of the household budget is

being eaten away by food and fuel.

• Widespread informal sector: Stunted middle class is considered both the cause and consequence of the widespread informal sector that is commonly estimated to account for 90% of employment but generates only a third of the value added to the economy.

• Contribution-benefit gap: There is a perception among the middle class that their contribution in the form of taxes is much more than the benefits they receive from government services.

• Limited social-economic mobility: The middle class may also face difficulties in improving their socio-economic status, as there may be limited opportunities for social mobility in the country.

o Also, barriers such as caste-based, gender-based discriminations further hinder socio-economic mobility.

Road ahead to overcome these challenges

• Improving public infrastructure: Better basic infrastructure is closely intertwined with productivity and inclusion. For instance, efficient and affordable transportation can enable finding better work farther away from home and create more options for leisure, recreation, and shopping.

• Enhancing formal economy: Connecting more working Indians with the formal economy could generate huge benefits at both the micro and macro levels.

o At the micro level, a greater sense of job security would positively affect longer-term financial planning.

o At the macro level, aggregate household consumption would rise, resulting in stronger domestic demand which

offers more opportunities for local entrepreneurs and small businesses.

• Tackling the cost-of-living issues: Decent, affordable, and accessible housing including home ownership is a key element of the middle-class status. Policies need to address shortages in the supply while helping households through demand-side support.

• Supporting education and health:

o Policies to support students from middle-income families for tertiary education include tuition fee loans and

assistance for non-tuition costs such as books can be considered.

o An expansion or deepening of healthcare cost coverage could provide substantial relief for the middle class.

• Possible reforms in the taxation system:

o Eliminating the “bracket creep” i.e., an inflation-induced increase in tax rates which affects middle-class

taxpayers in particular – could be considered.

o More generally, the tax burden should be shifted from labour to broader bases, including income from capital

and capital gains, property, and inheritance.

Read more about :‘take-make-dispose’ to Circular Economy model

To download :