PRADHAN MANTRI SHRAM YOGI MAAN DHAAN (PM-SYM) SCHEME

Recently, 21% unorganized workers have exited from the Pradhan Mantri Shram Yogi Maan Dhaan (PM-SYM) owing to growing inflation and high cost of living

Objectives of Pradhan Mantri Shram Yogi Maan Dhaan (PM-SYM)

- To ensure old age protection for Unorganized Workers.

Eligibility Criteria of Pradhan Mantri Shram Yogi Maan Dhaan (PM-SYM)

- Should be an unorganized sector worker

- Entry age between 18 and 40 years

- Monthly income below or INR 15000

- Should not be engaged in organized sectors (ESIC, NPS, EPFO etc) or income tax payer

Salient Features of Pradhan Mantri Shram Yogi Maan Dhaan (PM-SYM)

- It is a Central Sector Scheme administered by the Ministry of Labour and Employment.

- It is implemented through Life Insurance Corporation of India and CSC e-Governance Services India Limited (CSC SPV).

- LIC will be the Pension Fund Manager and responsible for Pension pay out.

- The enrolment will be carried out by all the Common Services Centres (CSC) in the

- There will be no administrative cost to the subscriber as it is a purely Social Security Scheme of Government of India.

Benefit of PM-SYM

- It is a voluntary and contributory pension scheme, under which the subscriber would receive a minimum assured pension of Rs 3000/- per month after attaining the age of 60 years.

- Also, if the subscriber dies, the spouse of the beneficiary shall be entitled to receive 50% of the pension as family pension.

- Family pension is applicable only to spouse.

- Requirements:

- Aadhar card

- Savings Bank Account / Jan Dhan account number with Indian Financial System Code (IFSC).

- Contribution by the Subscriber: Primarily, the mode of contribution is on monthly basis by auto-debit. However, it will also have provisions of quarterly, half yearly and yearly contribution.

- First contribution is to be paid in cash at Common Service Centre.

- The Union Government will also give equal matching contribution in his pension account.

- Once the beneficiary joins the scheme at the entry age of 18-40 years, the beneficiary has to contribute till 60 years of age.

- Exit scheme from Pradhan Mantri Shram Yogi Maan Dhaan (PM-SYM: The exit provisions of scheme have been kept flexible.

- If beneficiary moves to any organized sector and remains there for a minimum period of 3 years, his account will be active, but Government’s contribution (50%) shall be stopped.

- If he/ she exits the scheme within a period of less than 10 years, the beneficiary’s share of contribution only will be returned to him with savings bank interest rate.

- If he/she is unable to contribute owing disability or any other reasons, beneficiary may opt voluntarily to exit the scheme after minimum 5 years of regular contributions.

- Default of Contributions: If a subscriber has not paid the contribution continuously, he/she will be allowed to regularize his contribution by paying entire outstanding dues, along with penalty charges, if any, decided by the Government.

- One can join PM-SYM also in addition to Atal Pension Yojana, if eligible.

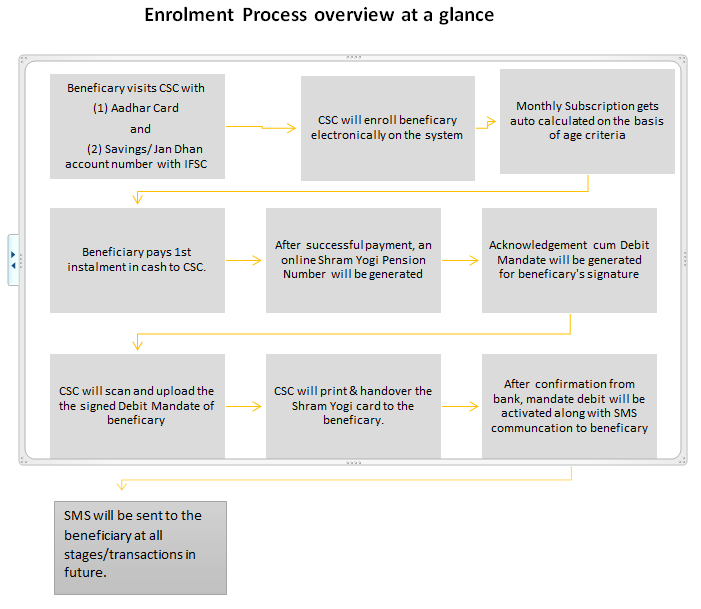

Enrolment Process for PM-SYM

- Interested eligible person shall visit nearest CSC centre. Location of CSC centre can be ascertained from the information page on web sites of LIC of India, Ministry of Labour and Employment and CSC.

- While going to CSC for enrolment, he shall carry with him the following :

- Aadhar Card

- Savings/Jan Dhan Bank Account details along with IFS Code ( Bank Passbook or Cheque Leave/book or copy of bank statement as evidence of bank account )

- Initial contribution amount in cash for enrolment under the scheme

- Village Level Entrepreneur (VLE) present at the CSC will key-in aadhar number, name of subscriber as printed on aadhar card and date of birth as given in aadhar card and the same will be verified with UIDAI database.

- Further details like Bank Account details, Mobile Number, Email-id, if any, spouse and nominee details will be captured.

- Self-certification for eligibility conditions will be done.

- System will auto calculate monthly contribution payable according to age of the subscriber.

- Subscriber shall also pay the amount of 1st subscription in cash to the VLE who will generate receipt to be handed over to the subscriber.

- Enrolment Form cum Auto Debit mandate will also be printed which will then be signed by the subscriber. VLE then shall scan the signed enrolment cum auto debit mandate and upload into the system.

- At the same time, a unique Shram Yogi Pension Account Number will be generated and Shram Yogi Card will be printed at CSC

- With completion of process, subscriber will be having with him Shram Yogi Card and signed copy of enrolment form for his record.

- He will also receive regularly SMS on activation of auto debit and Shram Yogi Pension Account details.