URBAN CO-OPERATIVE BANKS (UCBS) IN INDIA

About URBAN CO-OPERATIVE BANKS (UCBs)

Though not formally defined, it refers to primary cooperative banks located in urban and semi-urban areas. There are about 1,514 URBAN CO-OPERATIVE BANKS (UCBs) in the country.

- Regulation: In 2020, Government made changes to The Banking Regulation Act, 1949 and brought cooperative banks under the direct supervision of the RBI.

- The amended law has given RBI the power to supersede the board of directors of cooperative banks after consultations with the concerned state government. Earlier, it could issue such directions only to multi-state cooperative banks.

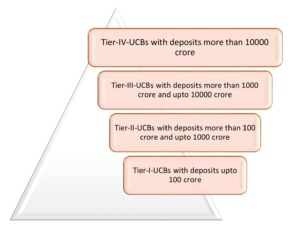

- To strengthen the regulatory framework and financial soundness of URBAN CO-OPERATIVE BANKS (UCBs), a four-tier structure categorization was introduced.

Categorization of URBAN CO-OPERATIVE BANKS (UCBs)

- Minimum net worth (MNW): Tier 1 UCBs operating in a single district should have minimum net worth of ₹2 crore. For all other UCBs (in Tier 1, 2 and 3) tiers), the minimum net worth should be ₹5 crore.

- Capital to risk weighted assets ratio (CRAR): Tier 1 UCBs have to maintain a minimum CRAR of 9% of Risk Weighted Assets (RWAs) on an ongoing basis. Tier 2 to 4 UCBs have to maintain a minimum CRAR of 12% of RWAs on an ongoing basis.

- Priority Sector Lending (PSL) targets: 75% of their advances have to comprise PSL, including loans to MSMEs, export credit, housing, education, and agriculture, among others.

Issues with URBAN CO-OPERATIVE BANKS (UCBs)

- High gross non-performing assets (GNPA): As per RBI FSB report (2023), Gross NPAs ratio for UCBs was 8.7% whereas it is just 9% for Scheduled Commercial Banks (SCBs).

- Also, increasing competition from SCBs as well as Small Finance Banks (SFBs) and Payments Banks.

- Governance issues: Vulnerability stemming from internal weaknesses, including the inability to prevent frauds.

For instance, collapse of Punjab and Maharashtra Cooperative Bank in 2019 following grave financial

- Inability to adopt best practices: Low capital base doesn’t allow them to deploy requisite resources in either manpower or in technology.

The state-of-the-art technology adopted by new players like fintech entities can disrupt the niche customer segment of the UCBs.

- High influence of top management: They are almost like a promoter-driven company wherein the top management, more often the chairperson, has significant influence over all the matters.

- High cost-income ratio: Most of the UCBs fail to operate efficiently and their cost-income ratio remains on a higher side. The average cost-income ratio of UCBs is roughly 10% higher as compared to commercial banks.

A lot of urban cooperatives are localised with processes and products designed to meet local needs.

- Face high credit, market, and liquidity risk: RBI’s Financial Stability report (June 2023) found that a few UCBs are highly vulnerable too Credit risk (default risk and concentration risk),

- Market risk (interest rate risk in trading book and banking book) and

- Liquidity risk

- Low share in banking sector: Market share of UCBs in the banking sector has been low and stands at around 3%.

Importance of Urban Corperative Bank (UCBs)

Good network at grassroot level

Tailored to local needs

Massive financial inclusion

Helps in economic upliftment of weaker sections

offers loans at reasonable interest rates

Large untapped area of expansion

predominant domestic orientaion

Other Initiatives taken for overcoming issues of URBAN CO-OPERATIVE BANKS (UCBs)

- Supervisory Action Framework (SAF): It seeks expeditious resolution of UCBs experiencing financial stress.

The SAF entails initiation of corrective action by UCBs and/or supervisory action by RBI on breach of the specified thresholds (triggers).

- Scheme for voluntary conversion: The RBI had announced a scheme for the voluntary conversion of eligible UCBs into SFBs in 2018.

- Umbrella organisation (UO): RBI had accorded regulatory approval in 2019 for formation of an UO for the UCB sector. The approval inter-alia permits UCBs to subscribe to capital of the UO on voluntary basis.

UO is also expected to set up Information and Technology (IT) infrastructure for shared use. It can also offer fund management and other consultancy services.

- Other steps:UCBs were permitted to provide door-step banking services to their customers. Individual housing loan limits for Urban Cooperative Banks have also been more than doubled.

Recently, The Reserve Bank of India has notified these vital measures to strengthen Urban Co-operative Banks.

- New branches: UCBs can now open new branches up to 10% (max 5 branches) of the number of branches in the previous financial year without prior approval (i.e., automatic approval) of RBI in their approved area of operation.

- The objective is to rationalize the process of branch opening and to enable the UCBs to tap growth opportunities in the sector.

- FSWM Criteria: To avail this facility, UCBs have to get the policy approved by their board and comply with the Financially Sound and Well Managed (FSWM) Norms.

- RBI terms select UCBs as FSWM subject to fulfilment of prescribed criteria .

Criteria for FSWM status

CRAR shall be at least 1 % point above the minimum CRAR applicable to an UCBs

Net NPA not more than 3%

Net profit for at 3 out of proceding four year

No default in th maintenanceof CRR/SLR

Sound internal control system with at least two professional directors on board

Core banking solution fully implements

No monetary penalty impose on account of violation of RBI guidline during two proceding years

- The branch expansion under the prior approval route as per the existing framework will also continue.

- One-time settlements: Co-operative banks through board-approved policies may provide process for technical write-off as well as settlement with borrowers.

- This has brought cooperative banks at par with other commercial banks

- PSL Target: RBI has decided to extend the timeline for UCBs to achieve Priority Sector Lending (PSL) targets by two years (i.e., up to March 31, 2026).

- Coordination with RBI: RBI has notified a nodal officer (in RBI) to meet the long pending demand of the cooperative sector for closer coordination and focused interaction

Conclusion

Long term growth of UCBs warrants rapid technology adoption, clear accountability processes and efforts to ensure

seamless integration with the overall financial system. Gradual but sustained adoption of these steps will ensure achievement of the vision- ‘Sahakar se Samridhi’.

Read about: PRADHAN MANTRI SHRAM YOGI MAAN DHAAN (PM-SYM) SCHEME