Global Debt of Developing Countries

Sri Lanka faces an unsustainable debt and a severe balance of payments crisis which highlighted the issues of growing debt of developing countries.

Growing debt of developing countries

• Developing countries often incur debt to fund large-scale infrastructure projects, such as roads, bridges, and power plants, to stimulate economic growth.

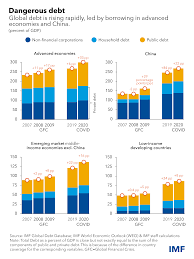

• In a recent, United Nations report “A world of debt. A growing burden to global prosperity” finds global public debt reached an all-time high of $92 trillion in 2022 from $17 trillion since 2000.

Developing countries’ public debt has increased from 35% of GDP in 2010 to 60% in 2021.

Also, public debt in developing countries has increased at a faster rate than in developed countries with almost 30 percent of the debt being owned by the developing countries.

Reasons for the growing debt of developing countries

• Higher costs of funds: When developing countries borrow money, they have to pay much higher interest rates than developed countries.

• More resources to pay interest: Currently, half of developing countries devote more than 1.5% of their GDP and 6.9% of their government revenues to interest payments, a sharp increase over the last decade.

• Relying on private creditors: Developing nations have markedly raised market-driven borrowings from private creditors like bondholders and banks, opting for commercial terms.

• This shift contrasts with traditional reliance on multilateral institutions for official credit.

• Issue in debt restructuring: Outsider creditors avoid debt restructuring of a country in crisis.

• Poor debt management and low government revenues: It is mainly due to inefficient tax policies and weaknesses in the rule of law are among the internal causes.

• Other factors

o The COVID-19 pandemic, the cost-of-living crisis, and climate change

o Debt trap diplomacy of china

o Limited sources of financing

source:IMF

Concerns raised due to high debt burden

• Issue of debt sustainability: The burden of debt pushes them to borrow from more expensive sources, increasing their vulnerabilities and making it even harder to resolve debt crises.

o Sri Lanka’s public debt is unsustainable, and as a result, the country lost international financial market access in 2022.

• Decreased Developmental spending: 3.3 billion people live in countries that spend more on interest than health or

education.

• Hamper’s sustainable development: Currently, over 70% of public climate finance takes the form of debt thus

countries in debt crisis tend to spend less on climate finance.

• Political and social turmoil: Masses blamed their government for the economic mess which resulted in political

instability.

• Global Financial Stability: High debt levels in developing countries can contribute to global financial instability.

Way forward

• Inclusive international financial architecture: Improve the real and effective participation of developing countries in the governance of the international financial architecture.

o Reforms such as updating IMF quota formulas to reflect the changing global landscape.

• Provide liquidity: Provide greater liquidity in times of crisis through IMF, and MDBs so that these developing nations do not opt for high-interest financing which is unsustainable.

• Transparent reporting of debt: Ensure that all countries adhere to comprehensive and transparent reporting of public debts.

o Greater transparency regarding public debt liabilities can help prevent the build-up of large “hidden” liabilities that in due course turn into explicit government debt.

• Prudent Debt Management Strategies: Lowincome countries must proceed prudently in taking up new debt, focusing more on attracting foreign direct investment and boosting tax revenues at home.

o Lenders need to assess the impact of new loans on the borrower’s debt position before extending fresh credit.

• Debt Restructuring: Promote collaboration among official creditors to prepare for debt restructuring cases that involve non-traditional lenders.

• Fulfilling climate finance commitments: climate change is one of the leading reasons for high public debt, providing credit for climate mitigation can avert the debt crisis.

Global initiatives to solve debt crisis in developing countries

• Role of IMF: The IMF is helping countries address large financing needs to prevent debt crises or, for countries already in debt distress, to restore economic and financial stability.

• Global Sovereign Debt Roundtable (GSDR): Launched in February 2023 by the IMF in coordination with the World Bank and India’s G20 presidency, the GSDR brings together key stakeholders involved in sovereign debt restructuring to foster consensus on debt and debt-restructuring challenges and how to address them.

• Debt Management and Financial Analysis System (DMFAS) programme of UNCTAD: The development objective of the DMFAS Programme is to strengthen the Government’s capacity to manage its debt effectively and sustainably.

• Heavily Indebted Poor Countries (HIPC) Initiative: The IMF and World Bank launched the HIPC Initiative in 1996 to ensure that no poor country faces an unmanageable debt burden.